UMortgage & HousingWire Forecast the Future of the Housing Market

June 13, 2023

UMortgage & HousingWire Forecast the Future of the Housing Market

There’s been no shortage of speculation regarding the future of real estate and the housing market. Are we in a bubble? If so, is that bubble about to pop?

In late May, Anthony Casa, UMortgage President & CEO, was joined by Logan Mohtashami, Lead Analyst at HousingWire, to take a deep dive into the metrics that have shaped the housing market both recently and long term in their Forecasting the Future event.

The pair analyzed the effects of low inventory, wildly fluctuating mortgage rates, and appreciating home values and how these three factors might shape the future of the real estate market and the housing industry. Logan used his robust market knowledge to analyze the data prior to the 2008 Housing Crisis and compare it to the events that shaped the current state of real estate.

So, if you’re wondering if the housing market is going up in flames, you’re in the right place. Below, we’ll delve into the current state of the housing market, the differences between now and 2008, and what you can expect for the remainder of 2023 and beyond.

What’s the Current State of the Housing Market?

It’s no secret that the real estate market is in a challenging place. A period of record low rates and rising sales numbers were immediately followed by the biggest sales collapse in one year in 2022.

“This is one of the most frustrating dynamics of housing,” said Logan while analyzing housing sales data. “On one side, everyone has a good loan and a very low total housing cost. On the other side, this creates housing inflation that we’ve never seen before.”

This period of housing inflation has had a domino effect on demand and inventory. Those who couldn’t buy a home while rates sat at record-low figures have either been priced out by the lofty mortgage rates in this current market or hold apprehension to buy a home in this market.

On the other side of the aisle, current homeowners aren’t listing their homes. Keep in mind that people don’t sell their homes to be homeless; a traditional seller is also a traditional buyer. These rate fluctuations have created more apprehension when it comes to individuals listing their homes, which is a negative hit to both supply and demand.

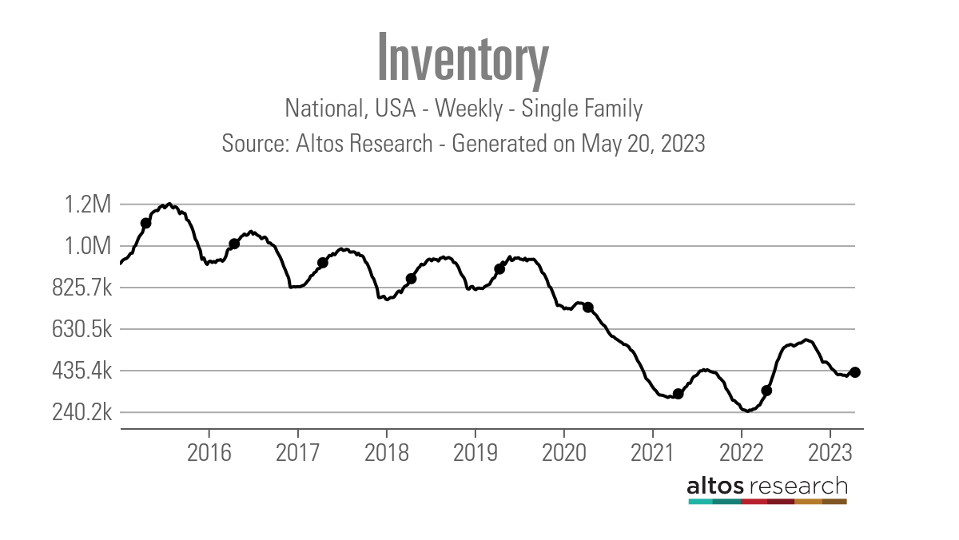

In the graph below, you can see housing inventory data for the last 7 years. Although inventory isn't quite at its lowest like it was in 2022, it's still significantly lower than what we see in a more 'normal' market.

“I don’t like to say that this is a housing bubble that we’re in right now,” Logan explained. “This was simply too many people chasing too few homes. When that occurs and it’s a supply-driven market, you can see prices accelerate out of control in a very short amount of time.”

“Don’t overcomplicate it,” continued Logan. “Lower rates, demand gets better, housing is stabilized; that’s the marketplace we’re in right now. We aren’t seeing a repeat of what happened in 2022, and the purchase application data is backing that up. Since November 9th, we’ve had 18 positive purchase application data weekly prints versus 8 negatives. That’s your housing market story currently.”

There are so many factors wedging the housing market between a rock and a hard place. But does that mean that we should anticipate a housing market crash on the horizon? Let’s talk about it.

What’s Different Between the 2008 Housing Crisis & Now?

If you’ve seen anything about the housing market on the news, you’ve probably seen financial analysts compare the current state of housing to the 2008 Housing Crisis.

While there might be the same fear, uncertainty, and doubt surrounding housing right now, 2008 welcomed several regulations to better protect consumers from predatory lending. There have been laws regarding lending practices, credit, foreclosures, and bankruptcy put in place to prevent history from repeating itself.

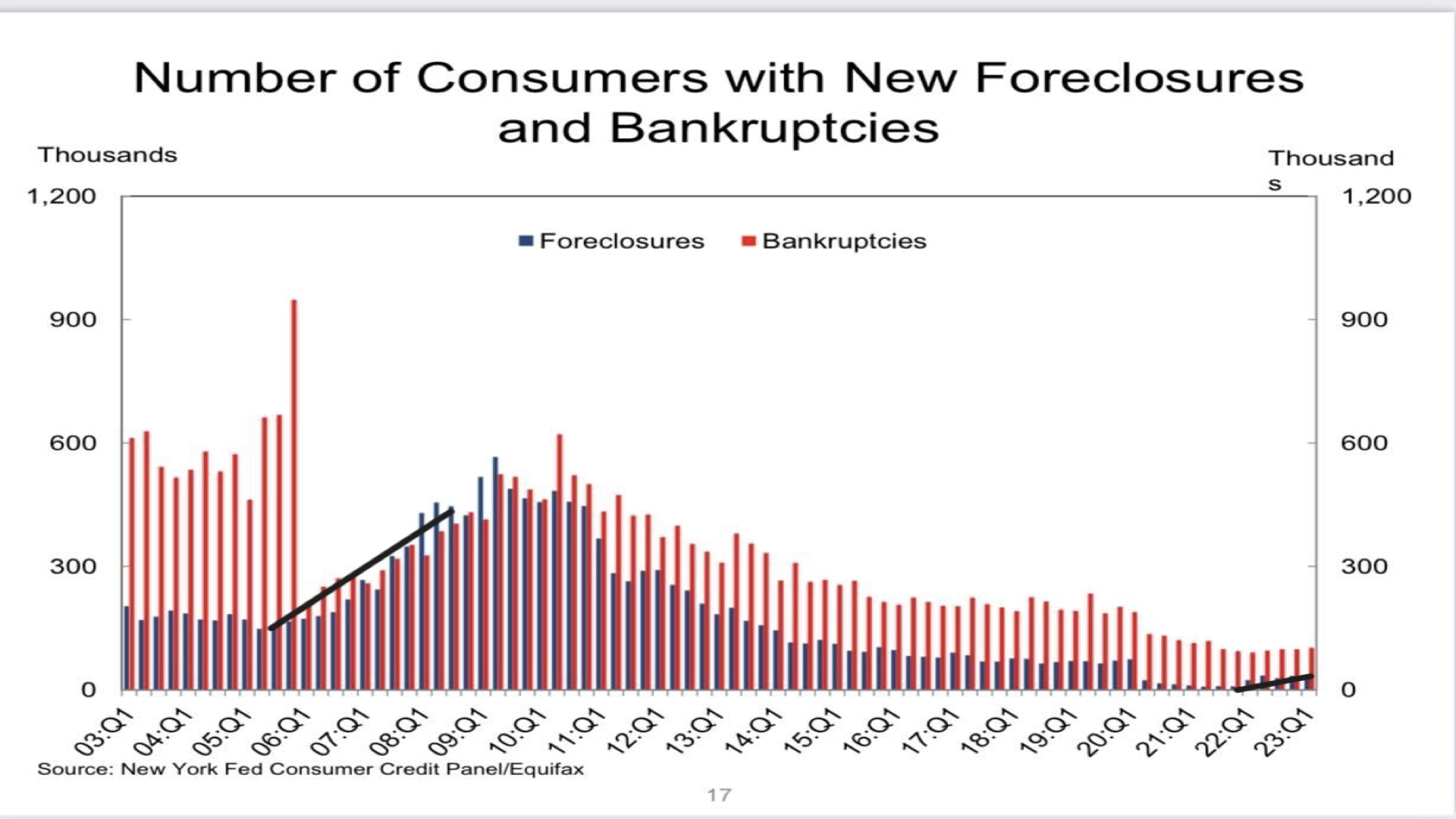

Take a look at the graph below outlining the number of consumers with new foreclosures and bankruptcies in the last 20 years. The difference in data from 2003 to 2011 and 2012 to 2023 is striking.

In 2005, the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) made multiple changes to the United States Bankruptcy Code – most notably that it became more difficult for consumers to file for bankruptcy. That’s why you’ll see that red line drop-off.

Then, in 2010, Congress enacted the Dodd-Frank Wall Street Reform and Consumer Protection Act. This law enforced a sweeping reform of the American financial system by “improving accountability and transparency in the financial system, to end ‘too big to fail’, to protect the American taxpayer by ending bailouts, to protect consumers from abusive financial services practices, and for other purposes.”

To put it simply, these laws work in tandem to ensure that individuals can only qualify for a mortgage if they’re qualified to borrow the large sums of money needed to buy a home. These regulations protect consumers from the all-too-common predatory lending practices.

These laws, combined with the increase in popularity of the 30-year fixed mortgage (rather than an adjustable-rate mortgage), ensure that homeowners are shielded from inflationary costs and rapidly rising rates.

“The United States has the best 30-year fixed and is one of the few countries that promote a 30-year fixed product,” said Logan. “That 30-year mortgage keeps that total housing debt cost at the same level while your wages rise. So even though inflation is rising, your total housing cost in a sense would be lower or the same.”

So, if you have clients who are worried about getting burned by another housing market crash, you can quote Logan: “We just don’t have the credit system in this country to allow for the events that cumulated into the 2008 Housing Crisis.”

What Can We Expect from Housing Moving Forward?

Now that we’ve cleared the air, what can we expect to happen to the housing market moving forward?

Fixing inventory is a tricky issue. As mentioned before, the average mortgage rate sitting around the 7% range creates an issue of affordability, especially for homeowners paying a low total housing cost thanks to the rate they got in 2020 or 2021.

However, rates decreasing will also create greater demand as first-time homebuyers and investors flock back to the housing market. Because the housing market is a supply-driven market, what needs to happen to create the right balance and fix the issue of demand?

According to Logan, “Demand needs to stay weak for long enough to allow inventory to increase and for us to see ‘days on market’ grow. Nothing good happens in the housing market when ‘days on market’ are in the teens or less.”

It all comes back to stability. Slowing inflation and a weaker labor market will see rates start to drop closer to the 5% range. If they can stay in that range for a prolonged period to shoulder the initial influx of demand, then homes should stay on the market longer and allow inventory to slowly accumulate.

At UMortgage, we’re homeownership advocates. This means that our Loan Originators work to educate homebuyers on every facet of the homebuying and homeownership processes to ensure that they’re empowered and confident in the decisions they make.

The Forecasting the Future event with HousingWire is one of the many opportunities that UMortgage LOs have to learn about the market and methods to navigate it in its different states directly from industry experts.

UMortgage’s LOs are creating life-changing opportunities through homeownership with coaching from the industry’s leading minds, robust lender optionality, competitive rates, an innovative tech stack, and an efficient operations process. Check this out if you want to learn more about the platform’s design to help LOs, borrowers, and real estate agents navigate this changing market.