How to Read Your Loan Estimate

Published: December 18, 2024

Updated: December 18, 2024

How to Read Your Loan Estimate

Getting your loan estimate is an essential step in the homebuying or refinancing process. What’s even more essential, though, is knowing how to read your loan estimate. We’ve seen plenty of clients work with other lenders and get hit with extra fees that were hidden in plain sight on their loan estimates.

Reading your loan estimate doesn’t have to feel overwhelming. This guide will break it down step-by-step so you can understand every detail and feel confident about your mortgage.

What is a Loan Estimate?

A loan estimate is a detailed document provided by your mortgage lender that outlines all the different details and fees that will go into your mortgage once approved. It details things like your rate, the type of loan you have, what your monthly payment will be, an estimate of your closing costs, and much more.

Remember, these figures are estimates. They can change if your mortgage rate, home price, or down payment changes. It’s important to work alongside your loan originator to understand all of the costs that go into your mortgage to make sure you know what you’re paying for and get the best deal possible.

The Different Sections of Your Loan Estimate

When you receive your loan estimate, you’ll notice that it’s broken down into a few different sections. It’s important to know what these sections cover and what they mean to avoid hidden fees and make sure your mortgage is structured the way you want it to be structured.Below are some of the sections you should review in detail and the different sections you’ll see on each page.

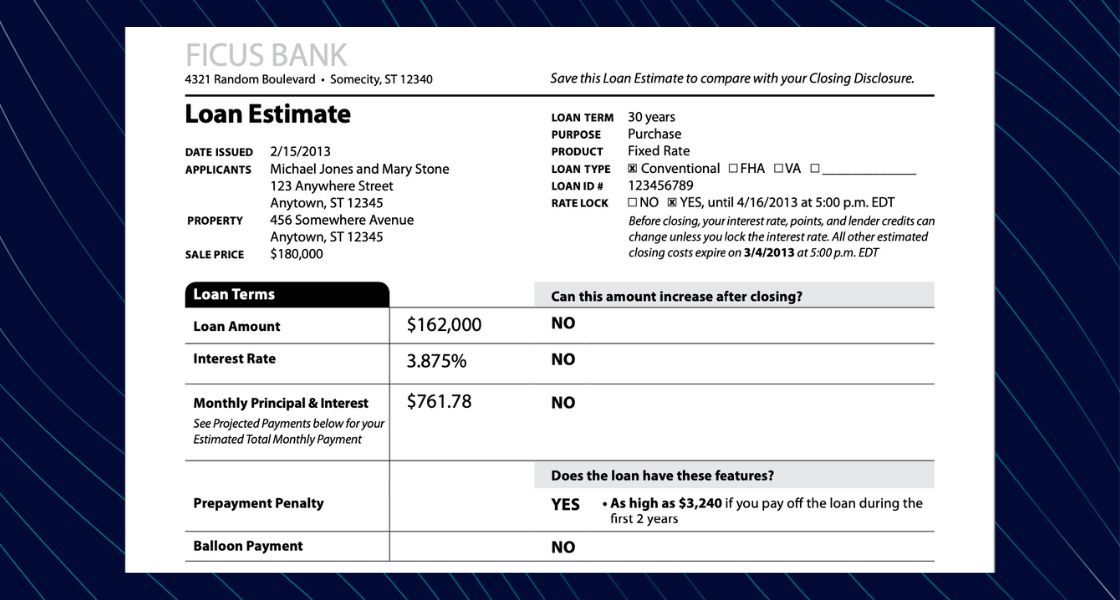

Page 1 - Loan Terms

Page 1 of your loan estimate summarizes the basic details of your loan. This includes your loan amount, interest rate, monthly principal & interest, prepayment penalty, and balloon payment. At the very top of the page, you can see whether you locked your rate, the length of your loan, and the type of your loan.

As you review this section, keep in mind the things you agreed upon with your loan originator. Things like whether you locked your rate, what type of mortgage you got, and whether or not your rate can or cannot increase after closing.

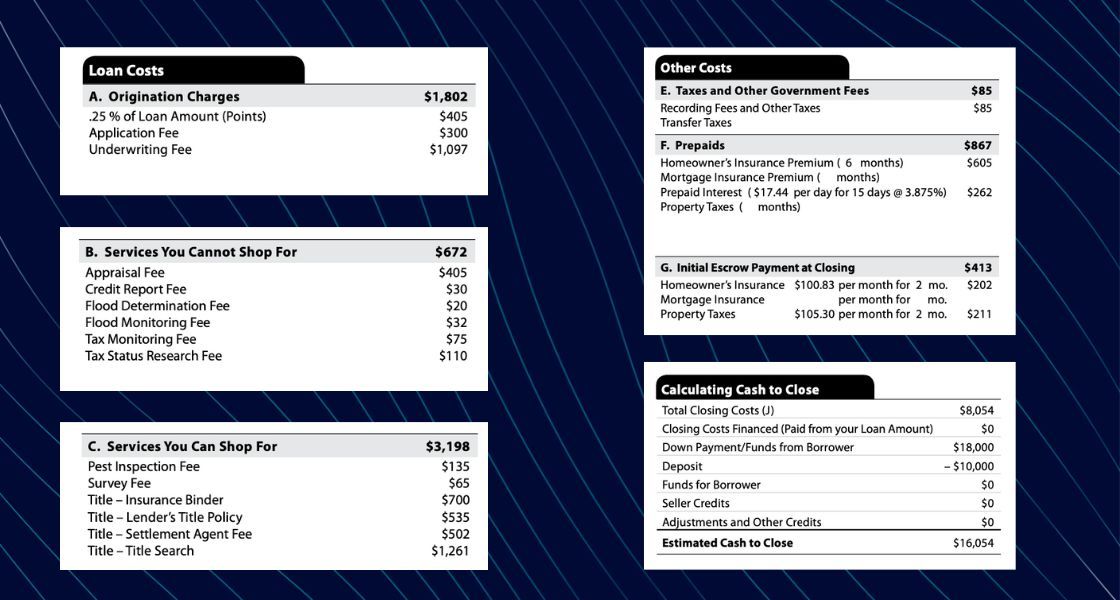

Page 2 - Closing Costs

Page 2 of your loan estimate will cover all of the fees that make up your closing costs. The only thing on this page that’s controlled by your loan originator is section A: origination charges.

This section includes charges like application fees, underwriting fees, or points to ‘buy down’ your rate. These are the only fees your loan originator controls, so review them carefully to ensure they align with what you discussed.

The other sections are the services that you can and cannot shop for, taxes and government fees, prepaid interest, taxes, and insurance, initial escrow payment due at closing, and other costs.

At the bottom of this page, you can see your estimated cash to close. This is the amount of money you’ll need to pay to close your loan and get the keys to your new home. It combines the fees outlined on that page with your down payment and accounts for paid fees like a deposit, seller credits, lender credits, and other things that help lower your total closing costs.

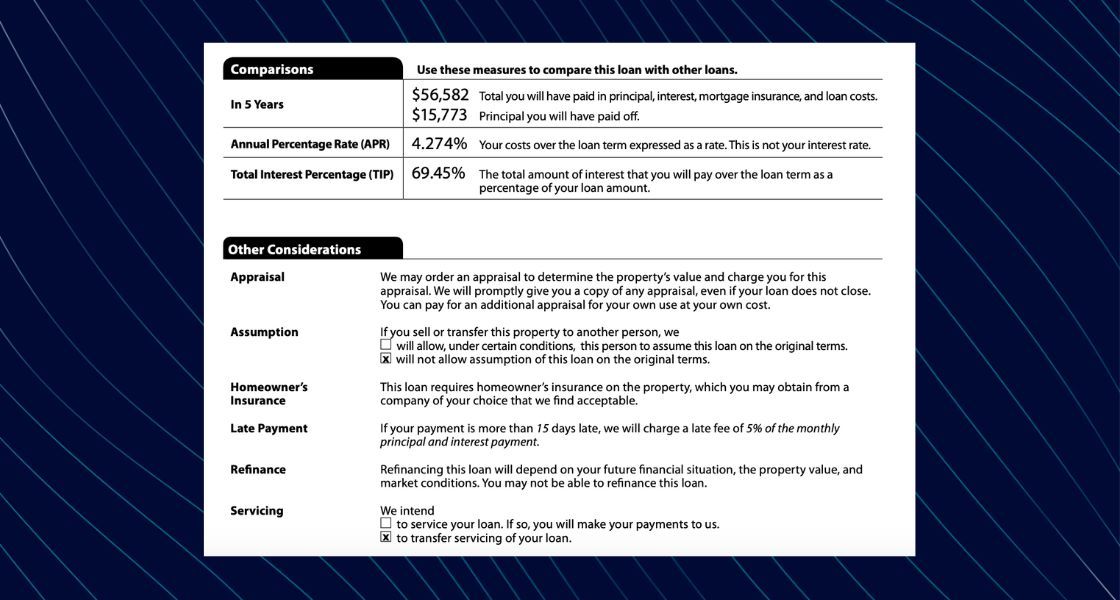

Page 3 – Additional Information

Finally, on page 3, you can see a few pieces of information specific to your loan. At the top of your page, you can find information about your lender and loan originator. Beneath that are figures that you can use to compare this loan estimate with any others you receive.

Finally, at the bottom of the page are details about your appraisal, loan assumption if you sell or transfer the property to someone else, late payment details, refinance qualification, and servicing.

Servicing lets you know whether your lender will transfer servicing of your loan to someone else. This is important to know—if your lender intends to service the loan, you will pay that lender each month. If they plan to transfer service, you will need to pay a different lender. You can confirm all of those payment details with the lender at the time of your closing.

How to Use Your Loan Estimate to Your Advantage

Understanding every section of your loan estimate will help empower you to shop around for the most affordable mortgage available with terms that fit your short- and long-term financial goals.

It will also protect you from different hidden fees that some lenders utilize to make a loan look more affordable than it actually is. The most common is discount points that allow a lender to give you a lower mortgage rate than the market allows. If you think your quoted rate is too good to be true, make sure to check section A on page 2.

Discount points aren’t always bad, but it’s important to know whether you’re paying them and if it makes sense to pay discount points before you sign the dotted line.

When you work with a UMortgage Loan Originator, you’ll unlock expert guidance to walk you through the entire mortgage process, including your initial loan estimate and your more detailed closing disclosure. You can also trust that you won’t get hit with any deceptive fees—just a mortgage that allows you to unlock the life-changing benefits of homeownership.

Want to get started? Follow this link and fill out the form to get connected with a Loan Originator in your area today!