UMortgage Announces Jimmy Hobson as National Sales Leader

Published: April 23, 2024

UMortgage Announces Jimmy Hobson as National Sales Leader

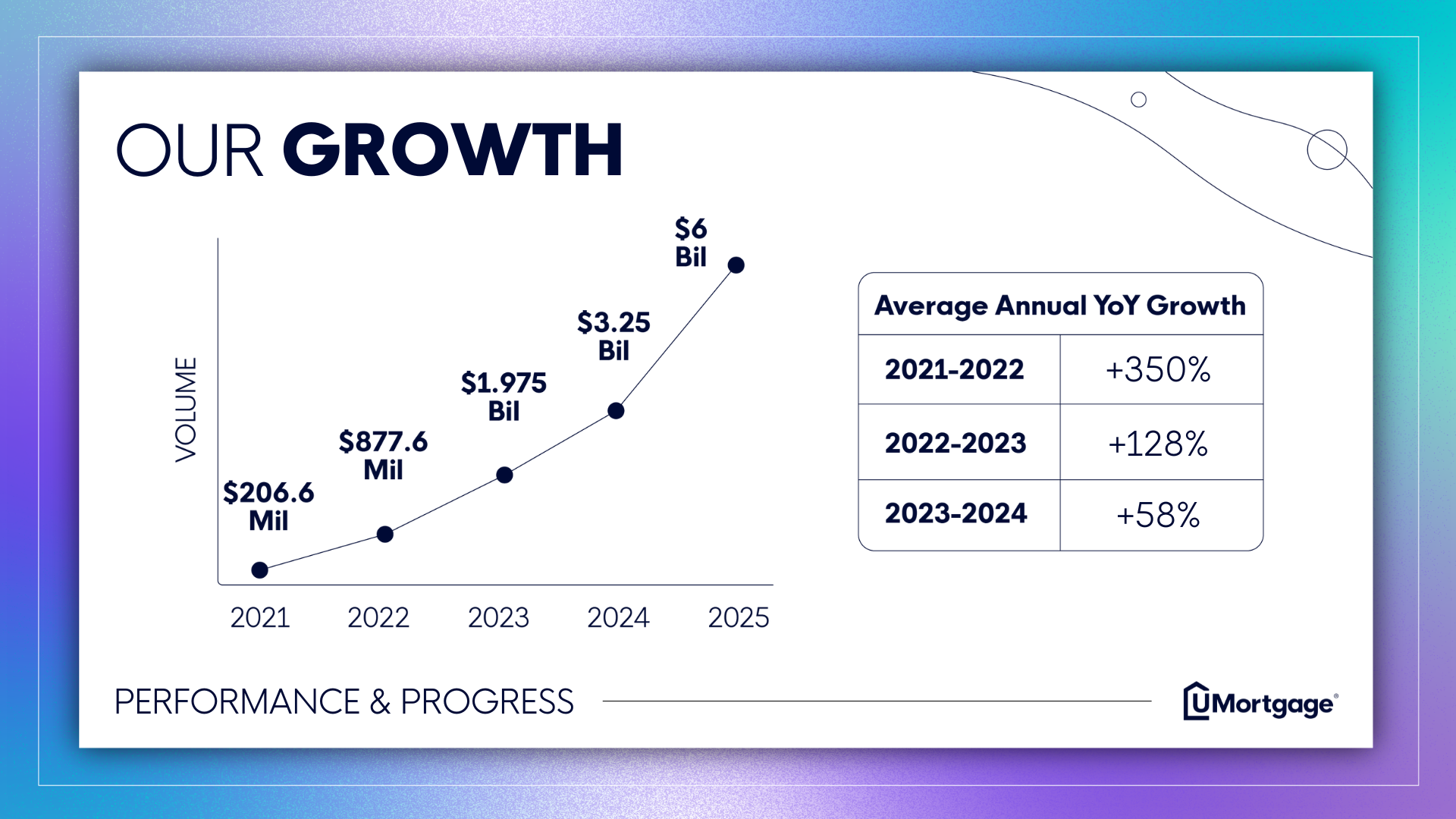

PHILADELPHIA, PA., April 19, 2024 — Following up on its record-breaking year of growth that culminated in a 127% year-over-year increase in funded volume in 2023, UMortgage clearly outlined its path forward for the remaining 3 quarters of 2024 and the years to come in its Vision, Goals, and Priorities presentation on April 18th.

It also announced new leadership to help those at the platform achieve these goals — including the promotion of Jimmy Hobson, former UMortgage West Branch Manager, as National Sales Leader.

“As a company, we’ve come a long way,” stated Anthony Casa, President & CEO. “When I founded UMortgage in 2020, $2bil in volume seemed like the moon to us. Now, we’re coming off a year in 2023 where we funded just shy of $2bil with +128% year-over-year growth, and that’s down to the ways that we’ve developed our culture, processes, and identity to give us this platform that we’ve been able to build upon.”

Having averaged that +128% year-over-year growth every year since 2021, UMortgage has cemented itself as the fastest-growing mortgage company in the country. Less than 3 and a half years into its business cycle, the Philadelphia-based mortgage platform is placed among the top mortgage companies in the country with 20 Loan Originators featured in the 2024 Scotsman Guide Rankings.

The evolution of leadership at UMortgage has been at the center of the platform’s growth since Casa founded the platform in 2020. During the presentation, it was announced that Hobson had been promoted to National Sales Leader. In his role, Hobson will implement set standards for loan submission, sales strategies, and marketing to foster a consistent mortgage experience across the organization.

“I’m humbled to be able to continue to drive this incredible company forward as its National Sales Leader,” said Hobson. “What’s needed for UMortgage to take the next step is synergy with everything we do. I’m going to spearhead better collaboration between Sales and Operations, more coaching opportunities to get everyone pulling in the same direction, and stronger lender relationships. We have a lot of talent here and with better alignment and coaching, we can work our way straight to the top.

Hobson joined UMortgage in 2021 to lead UMortgage West — the platform’s Utah-based branch — alongside fellow Branch Managers, Kyle Koller and Adam West. In less than 3 years, UMortgage West grew to become UMortgage’s highest-producing branch and served nearly 1,000 families for more than $340mil in volume in 2023. UMortgage is eager for Hobson to share the practices that helped facilitate UMortgage West’s growth across the entire organization.

Christina Escobar, former Loan Specialist Team Leader, earned an executive role after being promoted to VP of People. UMortgage also formally welcomed Mike Farah as Director of Sales Operations. Farah previously worked at the New Jersey-based brokerage Garden State Home Loans as its VP of Operations.

These new members of UMortgage’s executive leadership team will work together to help the platform reach multiple goals outlined in the Vision, Goals, and Priorities presentation. Under refreshed leadership, UMortgage has targeted benchmarks of 4 monthly fundings per LO, a loan cycle that’s 16 calendar days from TRID to clear to close, and a maximum cost per funded loan of $1,650.

These goals are central to UMortgage’s plan to become the best mortgage company in America. For UMortgage, this means a team-centric culture that offers all associated parties a consistent, communicative, and relationship-driven client experience.

With a fresh, experienced, and diverse leadership team driving these target goals, UMortgage plans to originate upwards of $6bil in yearly volume by the end of 2025. The platform is constantly growing and wants to do so with the best Loan Originators and Operations support in the country. Follow this link if you’re interested in learning more about UMortgage’s mission to create life-changing opportunities through homeownership.

About UMortgage

UMortgage is a national mortgage platform on a mission to create life-changing opportunities through homeownership for homebuyers across the country. With Loan Originators licensed from coast to coast, an expansive suite of lenders to shop from, and a quick, clear, & communicative homebuying process, UMortgage is ushering in a modern mortgage experience that can cater to any homebuyer.